52+ does a mortgage gift letter get reported to the irs

You may even have. Web WASHINGTON -- If you give any one person gifts valued at more than 10000 in a year it is necessary to report the total gift to the Internal Revenue Service.

Funding Your Mortgage Gifts And Gift Letters Deeds Com

No but your mother may be required to report this transaction to the IRS as a taxable gift.

. Web Mortgage gift rules and restrictions Note that the tax agency puts other limits on money gifts from one person to another. The date the funds were transferred. Lenders arent required to report mortgage letters to the Internal Revenue Service and youas the.

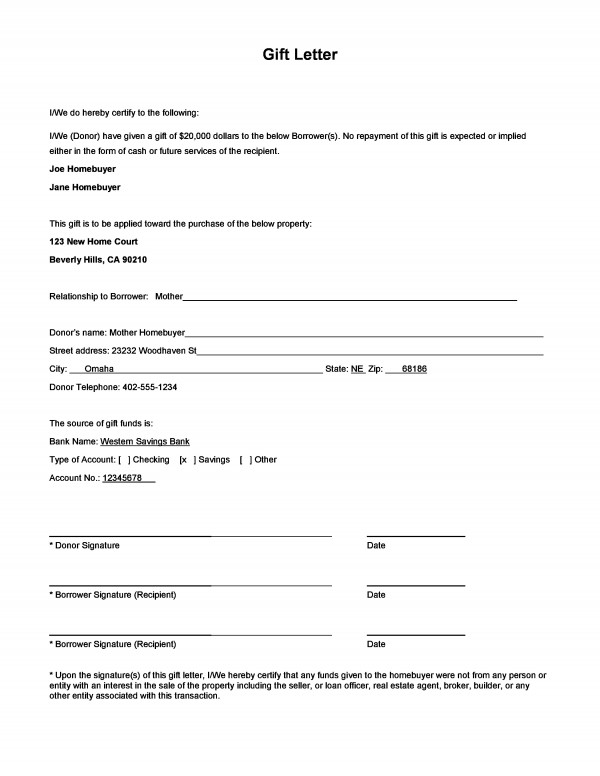

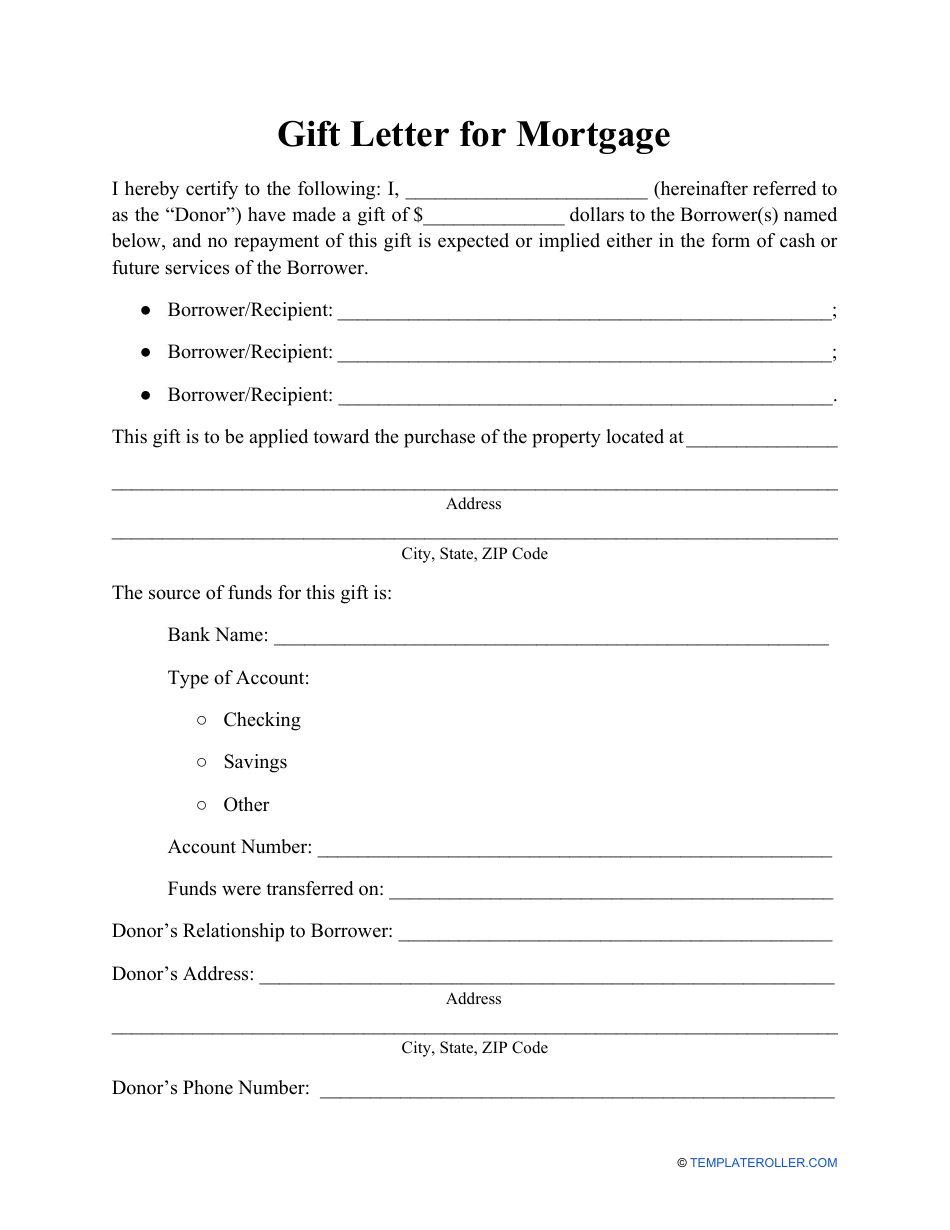

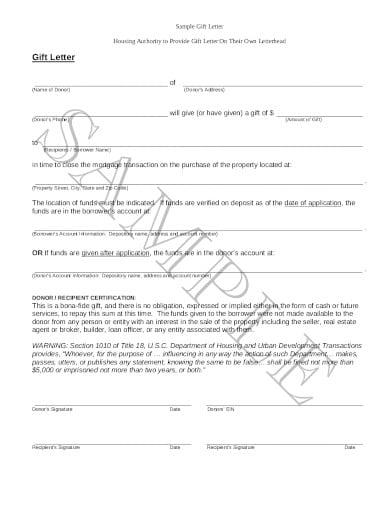

Heres a Thorough Guide - SmartAsset If youre looking to buy a home but dont have the cash to pay off your mortgage gift letters may. Web The gift letter must include the following information. Generally the transfer of any property or interest in property for.

Log in to your account. Web If you are concerned about the IRS or any tax liabilities for giving or receiving a gift please talk to a tax accountant. Though gift letters can cover any kind of gift made for any purpose they are most commonly used during the process of applying for a.

Web Make the steps below to fill out Gift letter for mortgage online easily and quickly. The dollar amount of the gift. During 2022 a family member can give.

Web Gift Letters and Mortgages. If you use more than 10000 in cash -- actual US. Web Does a mortgage gift letter get reported to the IRS.

Web If you plan to make a down payment of less than 20 you must contribute at least 5 of the funds yourself. Web Any one person can give a gift of 15000 without getting taxed on it. Web You make a gift if you give property including money or the use of or income from property without expecting to receive something of at least equal value in.

Web Regardless of whether youre getting a conventional FHA or VA loan a down payment gift is only acceptable when the house youre purchasing will be your. Web Like all financial institutions mortgage lenders are required by law to report large cash transactions to the IRS. The borrower may also use the gift received toward their earnest money.

Beyond that amount the gift must be reported on a gift tax return. But you likely still wont have. Log in with your email and password or register a free account to test the.

Web Gift Letters for a Mortgage. Web Fully 25 percent of homebuyers ages 23 to 31 and 17 percent of those ages 32 to 41 received gifts from relatives or friends to help with their down payment. The donors contact information.

Web The IRS currently gives people a lifetime gift exemption of up to 114 million which applies to any gifts you make over the course of your lifetime. All we are doing is documenting that the.

Paycheck Protection Program Obtainable Path To Loan Forgiveness Restaurantowner

Gift Letter For Mortgage Fill Online Printable Fillable Blank Pdffiller

Calameo Dwp Jsa Case Evidence The Sources Bibliography

Down Payment Gift Letter Definition Rules Template

2005 Index To Mn Business Periodicals

What Is A Gift Letter For A Mortgage

Free 10 Sample Transcript Request Forms In Pdf Excel Word

Gift Letter Template Fill Out And Sign Printable Pdf Template Signnow

Gift Money For Down Payment Free Gift Letter Template

Merrion V Jicarillo Pdf Tribal Sovereignty In The United States Government

Mortgage Gift Letter Guide Requirements Free Template

Gift Money For Down Payment Gift Letter Form Download

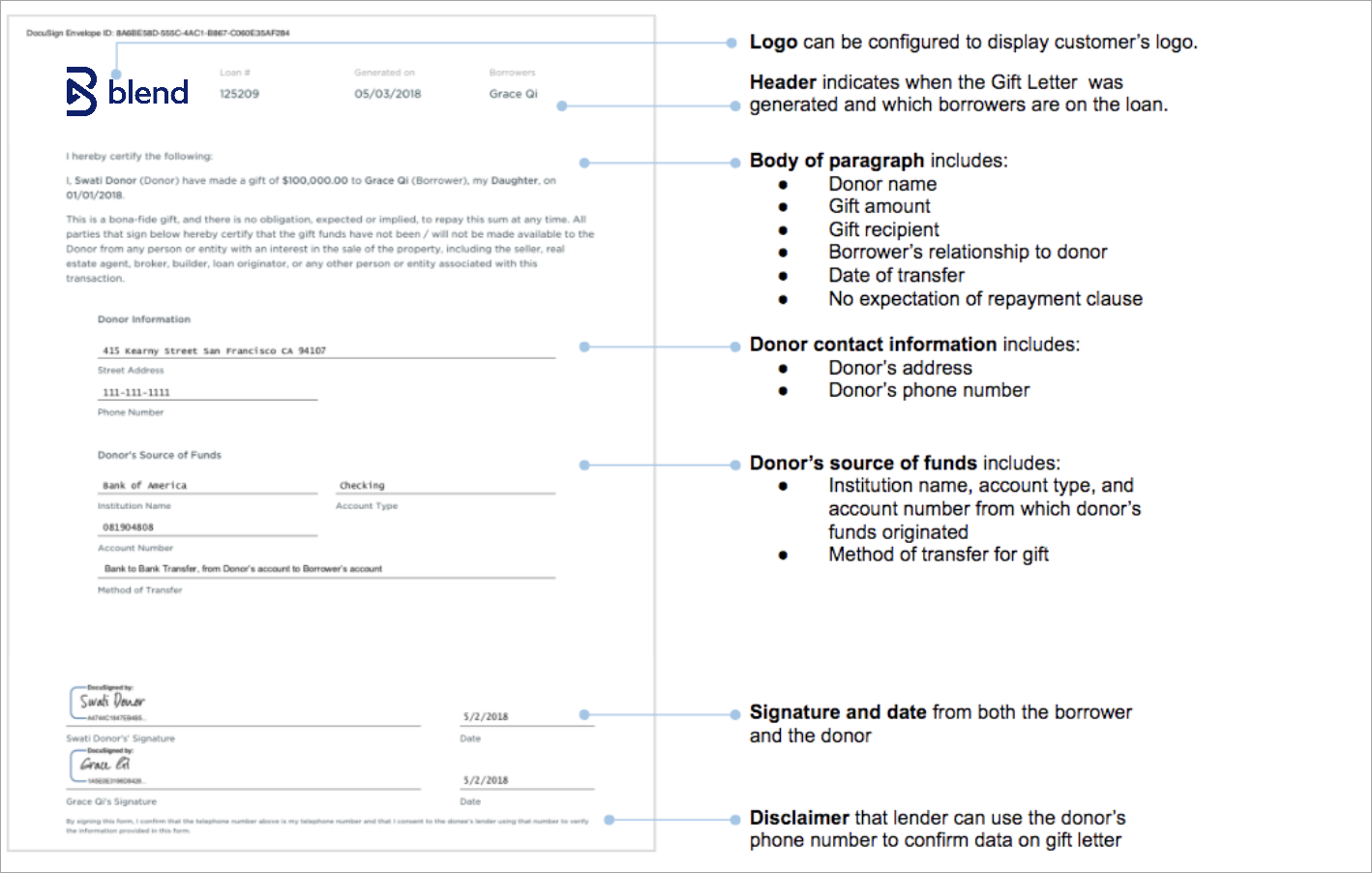

Letter Of Explanation Loe Gift Letter Blend Help Center

Gift Tax Fill Online Printable Fillable Blank Pdffiller

Gift Letter For Mortgage Template Download Fillable Pdf Templateroller

10 Mortgage Gift Letter Templates In Pdf Word

Mortgage Gifts